Product Excellence Through Modern PLM in Fast-Paced Markets

Modern PLM systems empower businesses to achieve product excellence in fast-paced markets by enhancing collaboration, agility and innovation.

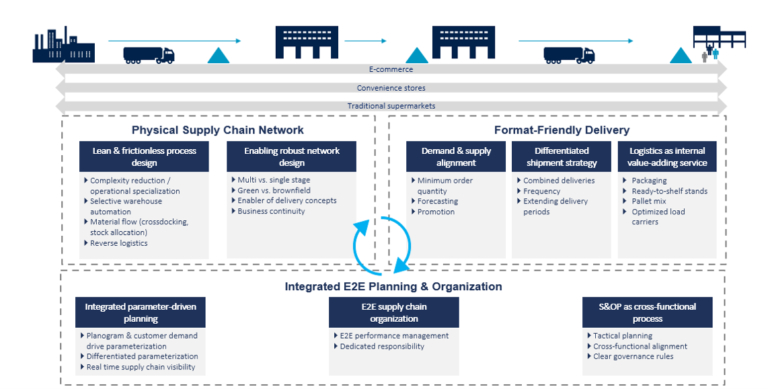

Designing a robust and frictionless supply chain network is an essential component of shaping future-proof grocery retail supply chains. Here’s how it works.

This article is part of a series on how to design the grocery retail supply chain of the future. In our previous articles, we have outlined the increasing significance of diversifying sales channels, shown the benefits regarding end-to-end supply chain cost, and provided insights into format-friendly delivery concepts. In this article, we will focus on the retailer’s network model as the key enabler of a successful grocery supply chain and the primary design parameters determining the final solution.

Retail logistics, as in most other industries, has been perceived purely as a cost element, which should cost as low as possible. Generally, logistics is frequently outsourced to global 4PLs or to regionally specialized 3PLs. In retail we see logistics undergoing the opposite trend and currently experiencing expansion and modernization of internal logistics capacities, only outsourcing isolated commodity services. The primary driver of this phenomenon is that logistics is a value-added service and potential differentiator within grocery retail, having direct influence on customer sensitive service dimensions such as on-shelf availability, freshness, convenience, etc.

Especially diversified premium retailers need to set up and manage a complex logistics network to provide the structured flexibility that is required in today’s retail business. On the one hand the network must work in sync to be (cost-) efficient and on the other hand the process landscape must serve the diversified customer/sales channel needs.

We at Camelot see two primary target design dimensions of a retail logistics network.

The physical network must ensure business continuity and set the foundation for a seamless interaction.

One immediate challenge grown retailers have, are their historical burdens, i.e. the existing network. Today’s customers’ needs, supply-/demand centers, the competitive landscape, and national infrastructure have shifted compared to to when most networks were originally designed. Although these assets are still very valuable, they do not provide the “whole package”. Careful analysis is required to identify selective network expansions or modifications. Especially, as e-commerce is expanding, an updated omnichannel network (e.g. more and smaller DCs with shorter reach) is becoming business critical.

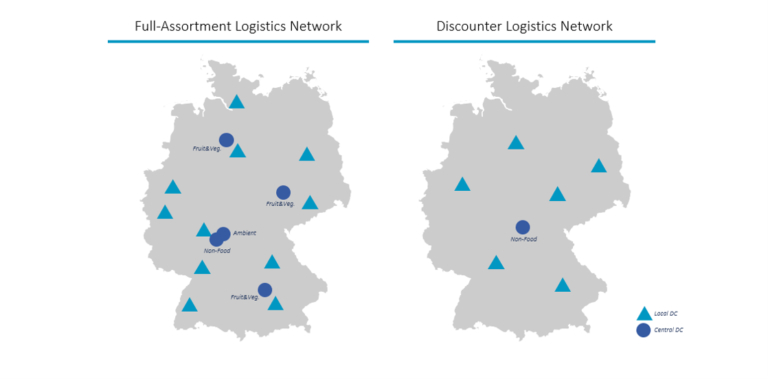

Another essential structural design element are network layers. Determining which functions a DC fulfills and how it is embedded in the overall structure is the foundation of material flow. We see many successful solutions in the market, each one contributing to the general business strategy of the company. Whereas discounters focus on fast turnover, their network is mainly built on single-stage and autonomous DCs. Full-assortment retailers typically rely on a multi-stage solution that enables a separation of slow- and fast-movers or diversified solutions dependent on the product assortment a DC accommodates (see exhibit 2). The “right-way” is entirely reliant on the retailer’s unique needs and topography it operates in.

Further specialized hubs are required quite often to enable a certain supply chain service. A common challenge we see for instance, are infrastructural bottlenecks, which restrict business as usual. Dense city centers, islands or sub-optimal roadways are the primary reason an area is not reachable within the standard network and preferred delivery concept. Additional crossdocking hubs or small depots can be the natural extension of a network.

Another issue we at Camelot often observe is how a retailer’s network structure considers diversified sales channels. Especially convenience or e-commerce formats have very different requirements compared to standard stores. Careful balancing is required to identify when a service justifies dedicated and separate solutions, which highly depends on market volumes and growth predictions. Special attention is necessary when integrating these specialized solutions (e.g. dark-stores or quick fulfillment hubs) into the existing network. It is important to consider their specific process requirements as they demand a more store-like rather than an inter-DC-like alignment.

The second target dimension is that the network structure enables a frictionless and lean process design despite the unavoidable complexity of retail logistics.

One key element is to reduce complexity and increase manageability of process flows. The network lays the foundation of this concept by fostering operational specialization wherever possible and needed. Typical use cases are separating operations by SKU turnover (slow- vs. fast-movers), packaging units (pallet vs. unit vs. piece) or storage/handling/delivery requirements. Despite potentially having the available capacity, it can be reasonable to enhance the networks footprint to improve operational performance and quality.

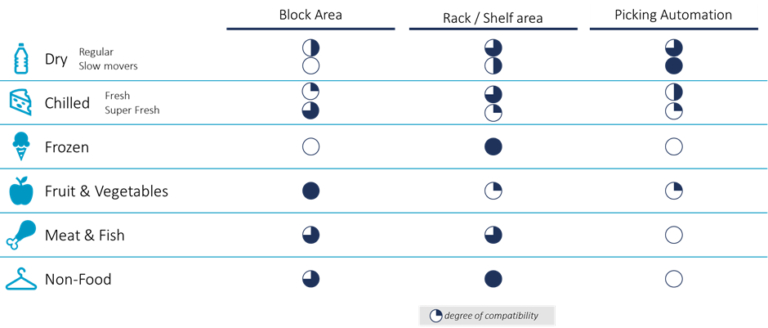

Warehouse automation and digitalization is another trend of the past years and is gaining even more traction. Especially in high-income countries retailers have invested heavily. Although all sections of a DC are affected by it, picking solutions typically provide the greatest ROI. We at Camelot see the need of carefully selecting a potential solution. Not all assortments have the same picking requirements and a practical implementation very quickly presents its drawbacks if not being prudent from the beginning. Exhibit 3 illustrates the general compatibility of picking approaches by product category based on our experience from several projects.

Next, we want to stress the importance of setting up a fluid down- and upstream material flow. The retail network design needs to consider where inventory is allocated, how it can be kept minimal for better responsiveness and maneuverability, where handover points from suppliers are and how to return transport units, recyclables and products in a structured manner. In case the reverse flow is not parallel to outgoing flows is must be made visible how DC handling and transport management go hand in hand that no idle state or overflow occurs by design. Retail logistics rely on a closed-loop model.

Last but not least, the organizational and cultural readiness for certain approaches and solutions also have a significant impact on a network structure. A network is managed by people, which require a certain set of know-how and capabilities to operate daily processes and therefore the underlying network design. In order to design a complex network with dedicated solution the organizational maturity has to be achieved as well. In some cases, the starting point of a fulfillment network redesign is not only a rational analysis of the SC fundamentals, but of the organization’s culture which has been shaped over time by hard constraints.

Overall, grocery retail supply chains are a highly complex and dynamic environment. Besides designing a performant, flexible and reliant network or synchronizing the integration of sales and logistics functions, it is critical to setup an end-to-end planning process and organizational setup. Keep following our blog series on this topic and feel free to contact us directly for more details.

This post is the fifth part of our blog series on how to build a future-proof grocery retail supply chain. Further parts of the series:

Part 1: How to Shape Your Future Supply Chain – Omnichannel in Full-Assortment Grocery Retail

Part 2: The Three Principles of Future-Proof Grocery Retail Supply Chains

Part 3: Grocery Retail: How to Align the Supply Chain towards Market Demands

Part 4: Boosting Sales Performance in Grocery Retail Supply Chains

Modern PLM systems empower businesses to achieve product excellence in fast-paced markets by enhancing collaboration, agility and innovation.

Read how the Campaign Planner & Designer (CPD) helps you to manage supply chain variability.

Explore automated production planning with our Campaign Planner & Designer.

The pharma market trends impact logistics with a shift to smaller, higher-value shipments and new temperature requirements.

© Camelot Management Consultants, Part of Accenture