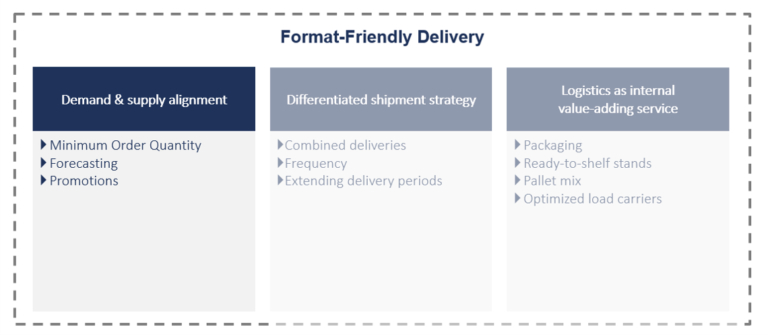

This article on Camelot´s perspective on guiding principles in supply chain grocery strategy dealt with demand and supply alignment in the building block of format-friendly delivery. We described three principles:

- It is important to ensure demand and supply alignment for the different sales channels through adapting the MOQ.

- Advanced forecasting methods which consider multiple variables and real-time information are key to establish transparency.

- Promotions need to focus on supply management and increased short-term responsiveness.

This post is the third part of our blog series on how to build a future-proof grocery retail supply chain. Further parts of the series:

Part 1: How to Shape Your Future Supply Chain – Omnichannel in Full-Assortment Grocery Retail