AI-Driven Application & Process Testing: Embracing Agentic Testing

Learn how Agentic AI enables digital transformation, delivering true hyperautomation.

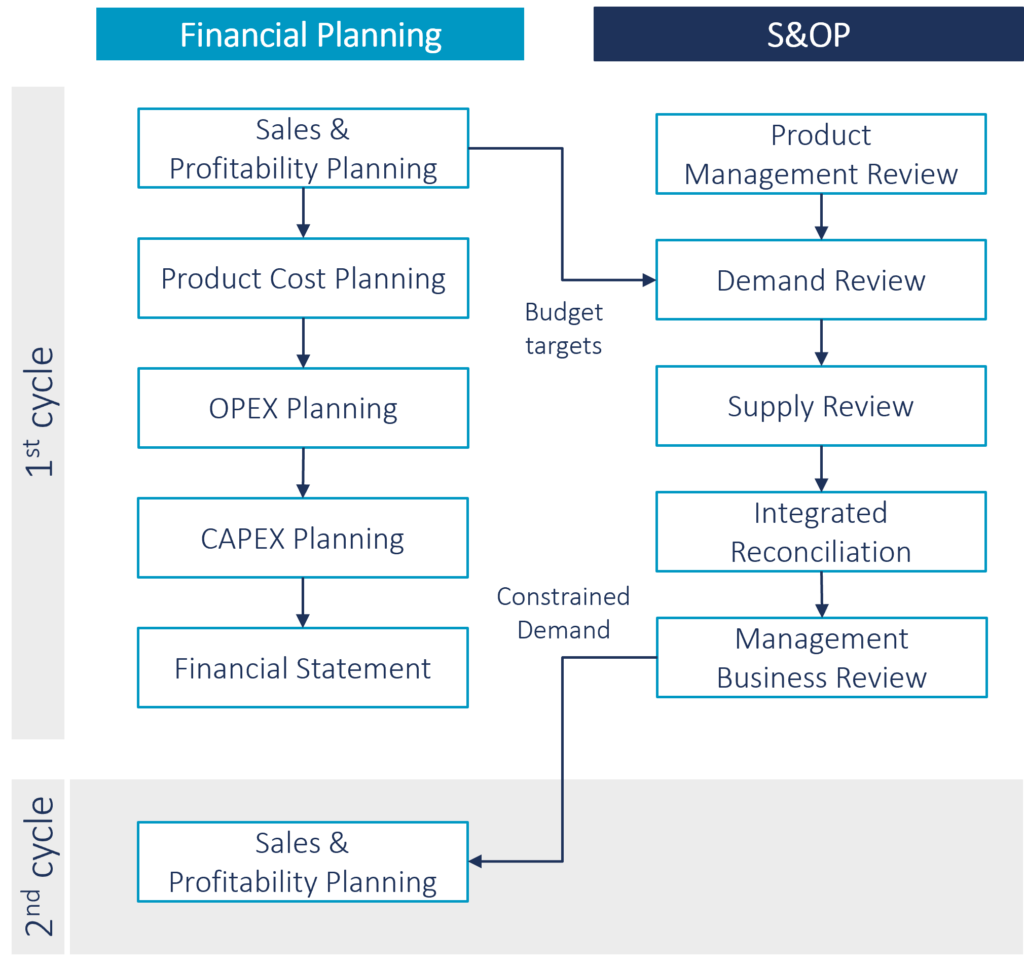

Many organizations struggle with a critical disconnect between financial planning and Sales & Operations Planning (S&OP). This fragmented approach creates a multitude of challenges. In this blog article, you will learn why connecting financial planning with sales and operational planning is crucial to steer your company towards success. We will also share how an integrated approach can be implemented using SAP technology. Finally, you will get an insight into a practical example based on one of our recent projects.

Gaps between financial and sales and operational planning manifest as siloed information, hindering collaboration and leading to outdated data reliance across finance and the supply chain. Without clear financial insights, the supply chain struggles to make informed decisions. Furthermore, limited scenario planning capabilities and unrealistic financial targets restrict informed decision-making, especially in critical situations. This widening gap between financial and S&OP planning demands a clear strategy to bridge the information divide.

The key to overcoming these hurdles lies in integrating financial, sales, and operations planning. This unified approach fosters alignment through:

Connecting financial, sales, and operational planning provides a multitude of benefits:

Firstly, increased transparency between financial and supply chain planning leads to enhanced data accuracy and reduced fluctuations. With both departments working from the same data set, discrepancies and misunderstandings become a thing of the past. This translates into more reliable forecasts and budgets, allowing for better resource allocation.

Secondly, supply chain planning can be strategically steered towards achieving financial targets. With clear visibility into financial goals, supply chain decisions regarding capacity, sourcing (make-or-buy), and resource allocation can be optimized to align with overall financial objectives.

Finally, the integration of sales, supply chain, and finance fosters a culture of collaborative decision-making. Consistent planning scenarios based on unified data empower all departments to work towards shared organizational goals. This fosters a sense of shared responsibility and accountability, leading to more informed and strategic choices across the entire organization.

A leading semiconductor company faced a decentralized planning process reliant on disparate Excel spreadsheets. This fragmented approach lacked comprehensive financial planning and integration with S&OP, leading to disjointed handoffs and inconsistent planning data.

The company undertook a strategic initiative to:

By implementing these changes, the company achieved:

Integrating financial planning with S&OP offers a powerful path towards achieving a truly unified business plan. By breaking down silos and fostering a collaborative environment based on shared data, companies can make more informed decisions, streamline operations, and achieve lasting success.

Authors: Henning Holländer, Alexander Föller

Learn how Agentic AI enables digital transformation, delivering true hyperautomation.

Reimagine resilience and proactively minimize supply chain risks

This article shall help you to understand how to optimize your inventory positions in a month – or even less.

Modern PLM systems empower businesses to achieve product excellence in fast-paced markets by enhancing collaboration, agility and innovation.

© Camelot Management Consultants, Part of Accenture

Camelot Management Consultants is the brand name through which the member firms Camelot Management Consultants GmbH, Camelot ITLab GmbH and their local subsidiaries operate and deliver their services.