Risk & Resilience in Logistics Network Design

Reimagine resilience and proactively minimize supply chain risks

In a series of blog posts, we are analyzing how disruptive market trends are changing supply chains in grocery retail. In this second post, we explain the three guiding principles of a future-proof grocery retail supply chain.

When designing grocery retail supply chains, the focus should not only be on core logistics functions such as warehousing and transportation. The most important enabler of an effective and efficient supply chain is to look at it from an end-to-end perspective. This can be strongly underlined by the cost situation. Supply chain costs account for about 9.5% of sales revenue. More than 50% of supply chain costs are directly related to in-store operations such as shelf refilling, and can only be optimized through specific warehouse or transportation operations.[1] Based on numerous projects in this field, we see an average cost reduction potential of about 11% in the end-to-end supply chain, depending on current supply chain maturity levels. As the existing supply chains are not set up for the new market developments and therefore imply even higher total supply chain costs, the benefits will be disproportionately larger considering the expected growth scenarios for e-commerce and convenience stores.

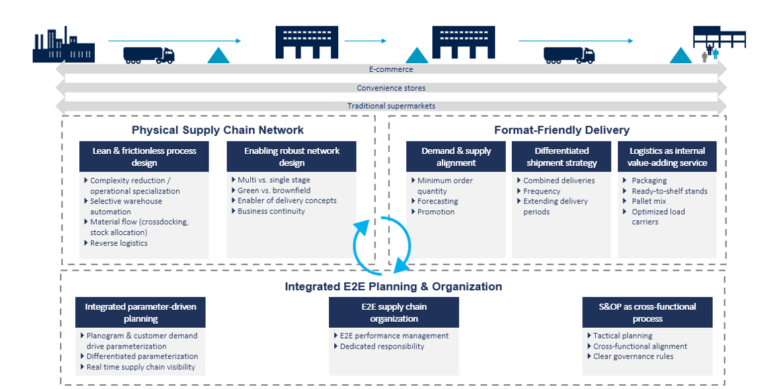

How can companies exploit the full potential of their supply chain in terms of customer satisfaction and cost competitiveness? According to our project experience and the latest trends in supply chain research, retailers should approach end-to-end supply chain design holistically, focusing on three guiding principles:

Format-friendly delivery is the starting point towards an end-to-end supply chain design. From our perspective, the journey starts with demand patterns. It is important to align store demand and supply in the best possible manner to reduce inventories, enable efficient store operations, and reduce shrinkage.

A frequent delivery pattern is needed not only for products with high demand, but also for low-demand products which require a certain freshness or have limited shelf life.

For some SKUs, supply might exceed demand with normal delivery quantities (e.g., supplier package, inner package). In these cases, it is important to find suitable solutions (e.g., piece picking) to balance supply and demand again.

Finally, logistics should become a value-adding service, meaning that the impact on stores should always be considered when optimizing logistics operations. One example of this is to have a close match between the warehouse layout and the store layout. If the warehouse layout was optimized independently of the store, a pure solution for efficient warehouse picking and pallet stack ability would be the result. By taking into account the store layout, pallets would be compiled directly for different store areas, thereby reducing sorting costs in the store.

A service-orientated supply chain network is the essential enabler for a successful grocery supply chain. As it takes significant effort and time to shape a network structure, it is often not ideally aligned with the much faster changing retail business environment. In the past years, retail logistics underwent a fundamental change to modernize and readjust its footprint. New sales channels, more volume, and a higher complexity have to be considered while typically gradually redesigning the network in a brown-field setup. Several parameters are crucial when undergoing a strategic network assessment. They can be differentiated into two categories: structural and process parameters.

Structural parameters focus on the high-level physical layout. The starting point of a design assessment is the current setup and the extent to which existing assets can be remodeled. Another essential matter is the number of stages the network needs to be comprised of. The main drivers of the network stages and functions are the business strategy, assortment characteristics, turnover, and the sales network. Based on the configuration of these dimensions, unique scenarios can be designed, which reflect the needs and topography the company operates in.

Process parameters consider the up- and down-stream flow of goods. One key element is reducing complexity and ensuring manageability of all processes. This view is necessary to understand which functions and the level of performance a network must provide. Additionally, several indirect functions can also be linked to the network layout, such as inventory management, warehouse automation, returns handling, etc.

The main challenge is to identify a solution which does justice to all design elements and therefore offers the performance, robustness, and cost-efficiency that is needed in retail logistics.

Setting up integrated end-to-end planning and organization is a key prerequisite to successfully drive the abovementioned measures and realize the attached benefits. First of all, this requires the implementation of an end-to-end supply chain operating model with accountability for end-to-end information and material flow (i.e., from supplier to the point of sale) in one hand. Secondly, a regular tactical alignment and decision framework—we call it Sales & Operations Planning—needs to be established to facilitate structured collaboration between all stakeholders along the supply chain (especially sourcing, supply chain/logistics, sales channels, and finance). And last but not least, the operative planning of the supply chain needs to be done in an integrated way driven by actual demand from the market side. This is achieved via segmented, data-driven, and frequently updated parameterization, which feeds modern planning systems and drives replenishment.

Given the pace of change in the grocery retail industry, modern supply chains need to constantly progress to provide the best service for customers. Hence, (re)designing the supply chain is not a one-off activity but an ongoing strategic endeavor to secure and grow the market position as well as stay relevant to customers.

In our upcoming blog posts, we will deep dive into each of the three guiding principles of future-proof grocery retail supply chains.

We thank Alexander Anagnostopoulos, Warehousing Director at AB Vassilopoulos, a brand of Ahold Delhaize, for his valuable contribution to this article.

[1] Camelot Benchmarking Database

This post is the second part of our blog series on how to build a future-proof grocery retail supply chain. Further parts of the series:

Part 1: How to Shape Your Future Supply Chain – Omnichannel in Full-Assortment Grocery Retail

Part 3: Grocery Retail: How to Align the Supply Chain towards Market Demands

Part 4: Boosting Sales Performance in Grocery Retail Supply Chains

Part 5: Setting the Table: Designing a Supply Chain Network in Grocery Retail

Reimagine resilience and proactively minimize supply chain risks

This article shall help you to understand how to optimize your inventory positions in a month – or even less.

Modern PLM systems empower businesses to achieve product excellence in fast-paced markets by enhancing collaboration, agility and innovation.

Read how the Campaign Planner & Designer (CPD) helps you to manage supply chain variability.

© Camelot Management Consultants, Part of Accenture

Camelot Management Consultants is the brand name through which the member firms Camelot Management Consultants GmbH, Camelot ITLab GmbH and their local subsidiaries operate and deliver their services.